Another Wall Street bank has boosted its S&P 500 target. Here’s why.

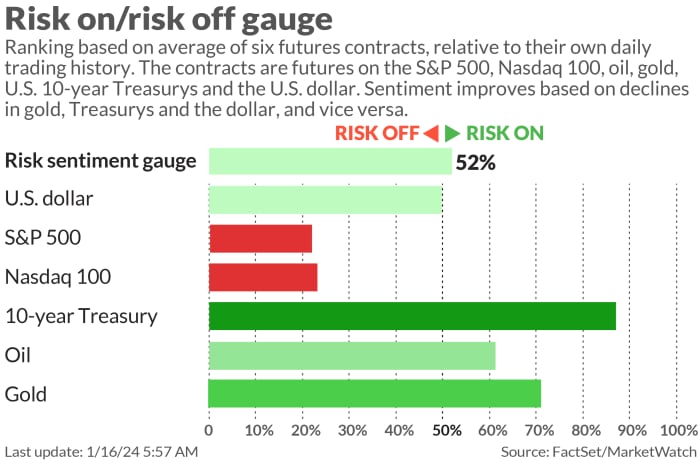

The return from a long holiday weekend is set to be a frosty one for investors, and not just that dangerous cold. Stock futures are dropping as bond yield rise, echoing Monday’s action in Europe after some hawkish regional policymaker talk.

Meanwhile, former President Donald Trump’s Iowa triumph, while expected, has sparked some chatter about a volatile election year ahead. (See chart below)

But we’re tuning into the optimists for Tuesday, with a call of the day from a Wall Street bank that has leapfrogged its year-end stock outlook.

A team of strategists at UBS led by Jonathan Golub now expect the S&P 500

SPX

to finish the year at 5,150 from a prior 4,850. Their outlook from last year had warned that odds were in favor of a better turnout for stocks, with robust earnings, easing inflation and monetary policy and an improved economic backdrop all likely.

“Given the Fed’s recent pivot, subsequent decline in rate expectations, and above-trend 2024 [earnings per share] revisions, we now embrace this upside scenario as our base case,” says Golub and the team. It’s now higher than UBS’s wealth management arm, which recently upped their index target to 5,000.

Bullishness from the UBS strategy team comes as stocks have gotten off to a rocky start, as some worry investors, armed with overly optimistic Fed rate-hike expectations, piled too quickly into stocks. Still, the S&P 500 sat just 0.27% from a Jan. 2022 record close on Friday.

The bank’s new S&P 500 target represents 7.7% upside from here, as they also boosted their 2024-25 earnings per share estimate to $225 from $235 and $246 to $250, respectively.

“Importantly, our growth estimates of 6.3% and 6.4% over the next 2 years are below the consensus of 11.4% and 12.8%. While earnings should drive

2024 returns, falling interest rates should support incrementally higher multiples,” said Golub and co.

The Swiss-headquartered bank’s new S&P 500 target puts it toward the top of Wall Street’s 2024 forecasts. Yardeni Research heads that with a 5,400 target, while JPMorgan brings up the rear with 4,200. In late December, Goldman Sachs lifted its own forecast to 5,100 from 4,700, not long after setting it.

The markets

Stock futures

ES00,

YM00,

NQ00,

are in the red, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

climbing. The dollar

DXY

is pushing ahead, with gold

GC00,

lower and crude

CL.1,

BRN00,

modestly higher. Natural-gas futures

NGG24,

are down 8%.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,783.83 | 0.43% | 0.91% | 0.29% | 19.62% |

| Nasdaq Composite | 14,972.76 | 3.09% | 1.07% | -0.26% | 35.14% |

| 10 year Treasury | 3.99 | -2.54 | 5.76 | 10.89 | 44.04 |

| Gold | 2,052.20 | 0.89% | 0.54% | -0.95% | 6.72% |

| Oil | 72.23 | 1.85% | -0.91% | 1.26% | -9.78% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

Goldman Sachs

GS,

stock is up after a fourth-quarter profit rise beat forecasts, with Morgan Stanley

MS,

rising on a big revenue beat. A trio of big banks including JPMorgan

JPM,

finished weaker on Friday after kicking off earnings season. The rest of the week will see more financial companies report, alongside Caterpillar

CAT,

The Empire State manufacturing survey hits at 8:30 a.m., with retail sales on Wednesday. Fed Gov. Christopher Waller is due to speak at 11 a.m. — a speech he gave last November tipped off the central bank’s dovish turn.

Tesla

TSLA,

CEO Elon Musk said he wants more control of the company, to which an analyst says he’s creating a “distraction.” Shares are down 2% in premarket.

Apple

AAPL,

is offering discounts in China for some of its iPhones. Shares are slipping.

Restaurant Brands

QSR,

-owned Burger King is buying its franchisee Carrols Restaurant Group

TAST,

in a $1 billion deal.

Berkshire Hathaway’s

BRK.A,

BRK.B,

Warren Buffett has been steadily boosting his stakes in five Japanese financial companies, says the CEO of one of those.

A deadly and dangerous Arctic cold front continues to sweep the U.S., shuttering schools and flights and straining communities.

Donald Trump won Iowa’s Republican presidential caucuses, while Florida Gov. Ron DeSantis came in second place.

The World Economic Forum in Davos kicks off in earnest on Tuesday, with climate change and artificial intelligence on the global priority list.

Best of the web

Americans need to make $120,000 a year to buy a home in 2024

China is telling some investors not to sell stocks, as the market struggles

What is Disease X? How scientists are preparing for the next pandemic

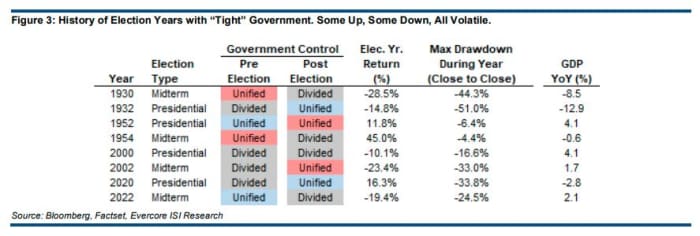

The chart

Evercore ISI’s Julian Emanuel has this warning: “The setup for politically inspired stock market volatility over the next weeks both in the U.S. and abroad is underpriced by investors.”

Focusing on the U.S., where the New Hampshire Republican presidential primary is now just around the corner, he offers up this chart:

“The history of U.S. election years where Congressional Control has been as politically “tight” (House 10 or fewer seats, Senate 2 or fewer seats) as in 2024 is unequivocally volatile for stocks – 5 of 8 years down, 2/3 up years with recessions,” says Emanuel.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

MARA, |

Marathon Digital |

|

MSFT, |

Microsoft |

|

AMZN, |

Amazon.com |

|

AMD, |

Advanced Micro Devices |

Random reads

Free love and daydreaming. The secret lives of rats.

New York lakeshore restaurant turned into ice castle.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.