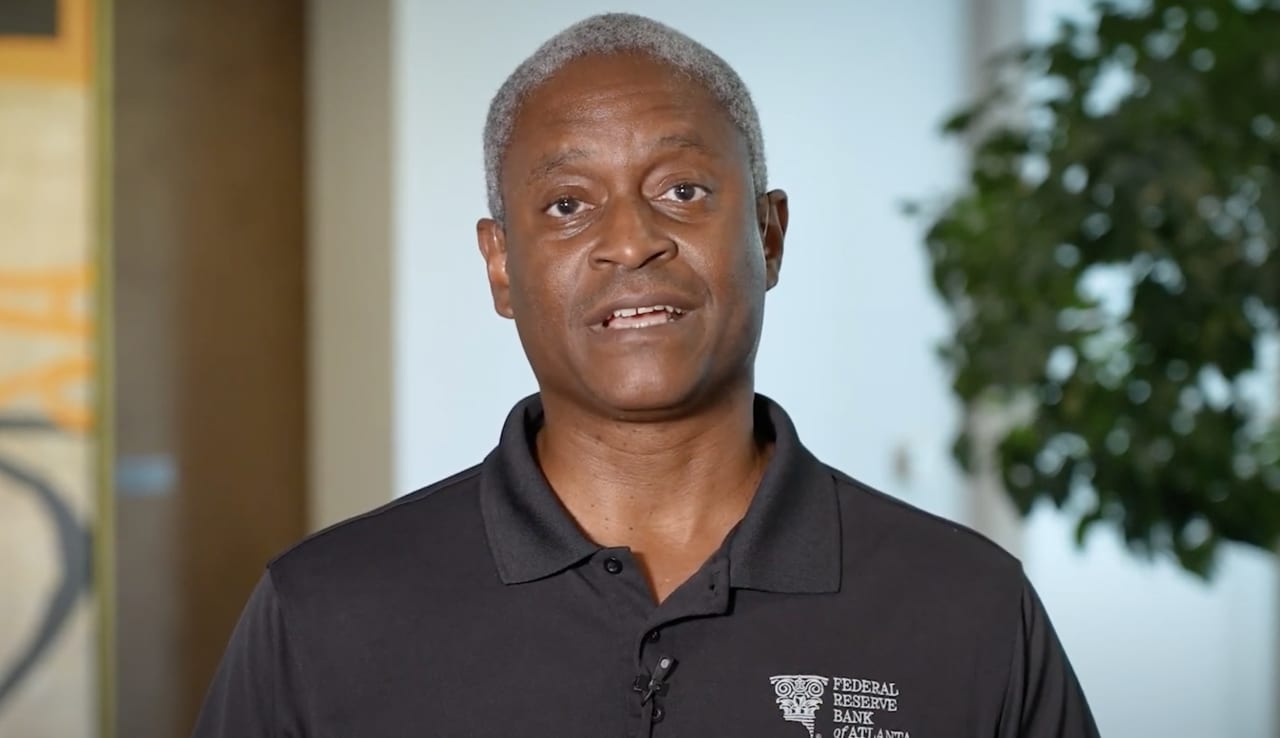

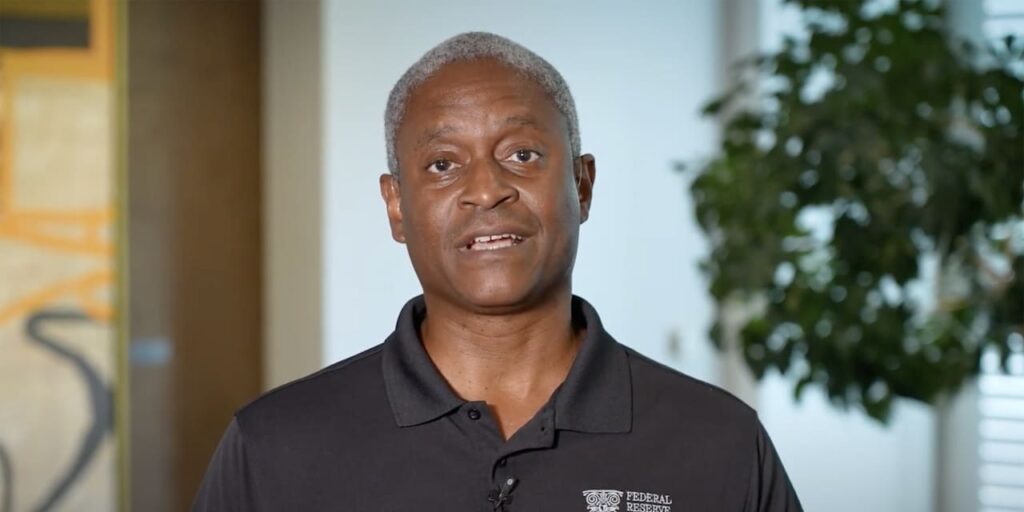

Fed’s Bostic makes case for first rate cut in July-September quarter

Atlanta Fed President Raphael Bostic on Thursday laid out the case for the central bank holding off from any interest-rate cut until the July-September quarter.

Bostic said he has recently moved up his projected time to begin reducing the Fed’s benchmark rate to the third quarter from the fourth quarter because of the unexpected progress on inflation and economic activity.

On reason to hold off earlier cuts is that the current economic environment is “unpredictable,” and it would be unwise to lock in “an emphatic approach” to interest-rate policy, Bostic said.

“Premature rate cuts could unleash a surge in demand that could initiate upward pressure on prices,” he warned.

Bostic’s speech is one of the last Fed speeches ahead of the central bank’s Jan. 30-31 policy meeting. There is a clear consensus in markets that the Fed will hold its benchmark rate steady in a range of 5.25%-5.5%. in two weeks.

Since the last Fed meeting in December, markets have been fairly certain that the first Fed rate cut would come in March. But that timing is now in doubt as Bostic is just one of several Fed officials who have pushed back on the notion of rapid rate cuts. At the moment, traders in derivative markets see just over 50% chance of a cut in March, according to the CME FedWatch tool.

In a recent interview with the Financial Times, Bostic said he has penciled in two rate cuts this year. That’s slightly below the median Fed forecast for three cuts in 2024. The market has priced in six.

In his speech, Bostic said it was possible he could get comfortable enough to advocate earlier rate cuts “but the evidence would need to be convincing.”

Bostic said he was watching the labor market closely. If employment growth slows more rapidly than he expects, he would have to adjust his interest-rate views. Keeping interest rates too high could risk unnecessary damage to the labor market, he said.

Still, at the moment, Bostic said very few of his business contacts expect layoffs.

Earlier Thursday, the Labor Department reported that claims for initial state unemployment fell to the lowest level in 16 months.

Stocks were mixed in trading on Thursday with the Dow Jones Industrial Average

DJIA

down slightly. The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

rose to 4.12%.