Firm that’s been saying cash is king says now is the time to switch to stocks

Cash, you are no longer king. Long live stocks.

That’s our call of the day from Barclays strategists who have switched their fealty from one of the year’s most popular investment choices to equities.

“After two straight quarters recommending cash over stocks and bonds, we now expect equities to eke out high single-digit returns in 2024 and outperform core fixed income,” a team led by Ajay Rajadhyaksha, global chairman of research at Barclays, told clients in a note Thursday. U.S. and European stocks, specifically, should enjoy those returns even if bond yields stay elevated, they say.

Yields on short-term instruments like 3-month bills

BX:TMUBMUSD03M

have been north of 5%.

Apart from Barclays (as far back as late 2022), hedge-fund billionaire Ray Dalio and DoubleLine Capital’s Jeffrey Gundlach have discussed the benefits of “T-bill and chill” this year, and millionaires and individual investors have been putting their money there. Gundlach more recently has said that investors would be better off with 2- or 3-year bonds.

But Rajadhyaksha and his team say it’s “time to take some risk” and investors can do better than that 5%.

So why not bonds? The Barclays team explained that the argument against that asset class has been clear — too many pricing in imminent interest rate easing and not understanding U.S. fiscal challenges.

Read: Stock and bond investors are convinced the Fed is finished with rate hikes. Why it isn’t a done deal.

And: Hedge-fund manager Harris Kupperman says clamor for bonds, Treasury bills makes no sense

Stocks were a tougher call and against expectations, higher interest rates have not led to lower price/earnings multiples, outside of a brief period in October, they say. An improved economy and hopes for AI-driven revenue and earnings have instead pushed stock gains, as a recent surge has also left the S&P 500

SPX

above Barclays’ year-end forecast of 4,200.

Rajadhyaksha said they still think double-digit S&P earnings growth forecasts for 2025 are too optimistic, but global economic downside risks have “diminished greatly. We think stocks will benefit from a fairly benign bottom to this business cycle and look through near-term earnings disappointments,” he said.

Overall the landscape is challenging, says Barclays. “In general, we do not see an asset class that is compellingly priced right now, whether extremely cheap or ridiculously rich,” said the team.

When it comes to where investors should put money in U.S. stocks, they admit megacap tech has gotten crowded, but that the market may not broaden out as long as tech high fliers are getting the only upward revisions by Wall Street. They suggest investors pick through discretionary names given the sector is under-owned and say outperformance for service-oriented stocks is likely. They like energy for valuation, capital return focus and the supply-driven upside potential for oil.

“We favor large cap over small cap to hedge against market shocks and for an uncommon opportunity to gain simultaneous exposure to quality,” add Rajadhyaksha and the team, who also like value over growth based on high real rate exposure and low international sales exposure.

Read: Options traders are piling into bullish bets on small-cap stocks at a record pace

The Barclays team suggests investors steer clear of China stocks, saying it’s better to “miss the first 10% of any prospective rally and buy only if there’s evidence that growth is picking up and retail investors on the mainland are buying into the rally.” But they do like the potential for Taiwan stocks given three tailwinds — signs of bottoming in China, waning geopolitical headwinds and signals of easier U.S.-China relations.

Best of the web

A secretive hedge fund tycoon is the world’s greatest shipwreck hunter

3 reasons why millions of older Americans live in poverty and aren’t getting the help they need

The chairman of the FDIC denied being investigated, and then changed his testimony

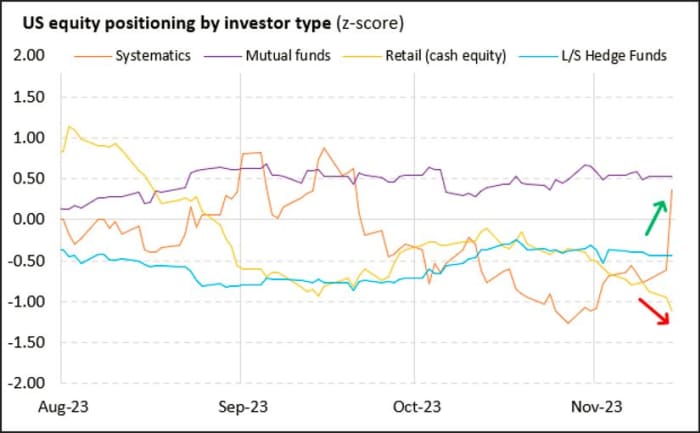

The chart

Who were the big buyers of Tuesday’s stock rally? Vanda Research says institutional buyers stepped in for fatigued retail traders, specifically “systematic strategies being forced to cover their short positions.”

Vanda Research

Systematic traders make use of factors such as quantitative models, historical data and technical indicators to figure out when to get in and out of trades. The Vanda team also says discretionary hedge funds have also been buying up some excess tech stock supply out there, and that may also help draw in retail investors ahead of seasonal tailwinds.

Random reads

“Ping you” and more Gen Z slang driving everyone else nuts.

That scannable Spotify tattoo seemed like a good idea at first.

Horse on a plane? Maybe not such a great idea.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.