Opinion: These stocks can be winners in AI because they all share this one quality

While the media would have investors focus on short headline-grabbing cycles such as political elections, central bank actions, and economic expansions and contractions, some investors — including our team at investment manager Alger — believe the ups and downs of such cycles are mostly noise, serving as a distraction for long-term investors.

Wealth creation is driven by innovation, which increases productivity, raises gross domestic product and ultimately boosts living standards. Innovative products and services that provide real value to businesses and consumers by making them more efficient, healthier, or happier, should find strong demand. These innovations reward investors over time, irrespective of elections and whether interest rates are rising or falling.

In its 60-year history, Alger has invested through many recessions and growth scares, as well as periods of such exuberance that capital was extremely cheap and abundant. Looking back at the ups and downs, two important lessons stand out:

- Research shows that innovation has grown through all kinds of economic volatility.

- Strong competitive advantages often translate into expanded market shares, particularly in challenging economic times.

In short, investors should consider investing in equities of innovative companies that aggressively capture market share in order to compound value no matter the macroeconomic environment.

Innovation is resilient

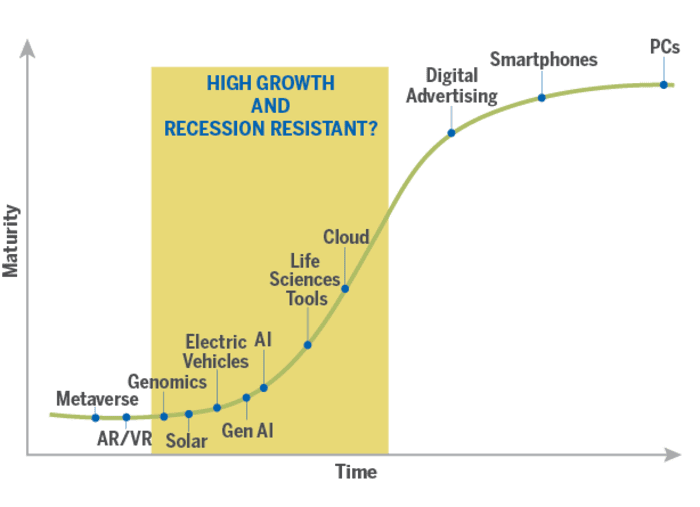

Productivity-enhancing technologies have a history of growing through both good and bad economic times. For example, personal computer use increased through the recession of the early 1990s while digital advertising and smartphones grew through the Global Financial Crisis. These technologies grew through adversity because they were early in their adoption cycle.

Today, these particular industries are mature and more cyclical, as shown in the chart below. However, the chart also shows newer technologies, such as artificial intelligence (AI), that are just coming up the so-called “S” curve. As a result, these newer technologies are more likely to garner an increasing share of business or consumer spending and as such, grow through various economic environments.

Source: Alger

Artificial intelligence

Bill Gates has said that artificial intelligence “is every bit as important as the PC, as the internet.” AI is a mega-theme that will impact business and investing for years to come. Through routine field research, Alger recently spoke with a multi-billion-dollar cloud service consultant who shared that technology solutions, such as AI, may end up feeling like “need-to-haves” because of the vital business importance of digital transformation and the belief that companies will use these tools to reduce costs.

The adoption of this technology will persist irrespective of the pace of economic growth. Finding beneficiaries of this trend can generate strong returns for investors. Below are some potentially attractive investments in the AI space.

We refer to the companies that provide the infrastructure for AI services as “enablers.” Some of the most important components of the AI infrastructure are semiconductors. These chips provide the industry with the processing power that is seeing soaring demand.

Consider that one of the main determinants for the intelligence of generative AI programs, like ChatGPT, is the amount of training that they undergo. That training is doubling roughly every four months, much faster than the two years that Moore’s Law has accurately forecasted the number of transistors will be crammed onto computer chips. This difference in speed is so massive that a six-inch plant growing at Moore’s Law would be 16-feet tall in a decade, while if it grew at the speed of AI, it would reach the moon.

Some of the leading chip providers to the AI industry with innovative technologies include Nvidia

NVDA,

Marvell Technology

MRVL,

and Advanced Micro Devices

AMD,

The immense computational demands of AI require the development of groundbreaking chip and server architectures, which together drive greater power consumption per server cabinet within the giant data centers that house the brains of these systems, leading to higher electricity consumption. According to Schneider Electric

SU,

AI power usage will increase more than 30% annually, resulting in a cumulative increase of four times the current usage over the next five years, as measured in gigawatts.

However, higher power densities in AI tasks lead to excessive heat generation, posing cooling challenges for data centers. Today, companies like Vertiv Holdings

VRT,

not only solve this overheating challenge but potentially improve cost and energy efficiency.

As data centers expand to meet the growing demand for AI, lack of transmission and distribution of power could prove to be a key issue. This may necessitate grid modernization, potentially benefiting power management and electrical services companies that work with utilities and commercial customers. Companies like Eaton

ETN,

a diversified global power management company, are working hard to meet growing electricity demand and in the process may generate attractive returns for shareholders.

Driven by data

“If AI is a rocket ship, data is the fuel. ”

In today’s economy, data is the new oil — a very important raw material for digital transformation. To automate and make software work for us, we need our data digitized and organized. Artificial intelligence is particularly dependent on good data. If AI is a rocket ship, data is the fuel. Unstructured data such as text messages, emails, social media, webpages and business documents all need to be accessible by software programs like generative AI.

One company that helps businesses store and organize their unstructured data in a database management system is MongoDB

MDB,

Gartner estimates the data management market may grow 17% annually from 2023 to 2027, making this an attractive investment area.

Prepare for all possibilities

Alger believes investors should aim to position portfolios for a range of economic outcomes by investing in companies that will gain market share within the economy. Companies that enable AI such as chip makers, power management companies and database providers may be good examples of companies that are providing innovative products and services to customers around the world. They can grow through good and bad economic environments, allowing investors to ignore the noise and focus on long-term wealth creation.

Brad Neuman is Alger’s director of market strategy . As of Oct. 31, 2023 (Alger’s most recent reporting date), the firm had positions in MongoDB, Nvidia, Marvell, Advanced Micro Devices, Schneider Electric, Vertiv and Eaton.

More: Intel’s new AI chips for the PC will be widely used, but may not be the most useful

Plus: Whether it amounts to an actual recession is uncertain, but the U.S. is headed for a soft patch, economists say