Tom Lee has four reasons corporate earnings are better than they appear.

CNBC commentator Jim Cramer is now telling worrywarts who have parked their money in CDs or Treasurys to “find some room for stocks,” which to followers of the pundit’s oft-awry track record is surely a warning sign. In fact, times are so good that one Goldman Sachs pro wrote that the “most compelling reason for a potential sell-off is that I cannot find one.”

Onto analysis from the rose-colored-glasses Tom Lee, the head of research at Fundstrat, who took a look at U.S. corporate earnings at the halfway point of fourth-quarter results reporting season.

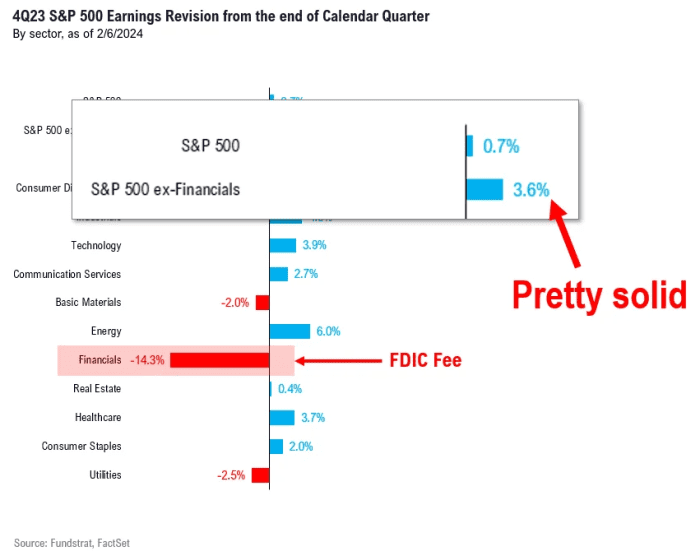

He notes that earnings per share estimates tend to rise by 3% from the start of the results season, but this year the gain is only 0.7%. That figure is understated though, Lee says.

The EPS estimates of financials have dropped by 14% as a result of the $23 billion fee assessed by the Federal Deposit Insurance Corp. to rebuild the insurance fund after the bailout of regional banks. Excluding the assessment, and EPS is 3.6% above the start of the quarter, above the 3.2% average.

Another positive: companies that beat are seeing one-day stock-market gains of 1.1%, above the 0.8% in the third quarter, and the best since fourth quarter of 2022.

A third positive is that the percentage of companies reporting double-digit earnings per share growth is now at 43%, which to Lee “sort of solidifies” that the first quarter of 2023 was the end of the EPS recession, when that figure bottomed at 36%.

And finally, Lee draws inspiration from the Chinese stock market showing signs that it’s bottoming. “While this is only the stock market bottom, equities are often leading indicators for the economy. And moreover, an improving China would strengthen the case that US and global PMIs have bottomed. And in turn, that supports improving EPS throughout 2024,” says Lee.

The markets

U.S. stock index futures

ES00,

NQ00,

were flat, after the S&P 500

SPX

ended at the second-highest level in history. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 4.12%.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,954.23 | 2.24% | 3.57% | 3.87% | 20.31% |

| Nasdaq Composite | 15,609.00 | 2.93% | 4.27% | 3.98% | 31.05% |

| 10 year Treasury | 4.119 | 20.02 | 8.52 | 23.83 | 49.82 |

| Gold | 2,049.00 | -0.43% | 0.95% | -1.10% | 8.52% |

| Oil | 73.79 | -2.72% | 3.46% | 3.45% | -5.98% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

Regional banks will be back in the spotlight after a 22% share-price slide for New York Community Bancorp

NYCB,

on Tuesday, and as Moody’s late Tuesday cut the credit rating on the bank to junk.

Ford Motor Co.

F,

reported stronger-than-expected profits as it set out a plan to make smaller electric vehicles.

Social-media service Snap

SNAP,

had another catastrophic earnings report, that sent shares down some 30%.

Walt Disney

DIS,

Fox

FOX,

and Warner Brothers Discovery

WBD,

agreed to a joint sports-streaming app, while an activist investor called for breaking Disney into three ahead of the company’s results after the close. Uber Technologies

UBER,

and Fox Corp. are among the companies reporting results.

Nikki Haley lost to “none of these candidates” in the Nevada Republican primary, though the caucus that actually awards delegates takes place Thursday.

Another big day for Fedspeak has Fed Gov. Adriana Kugler making her first speech since joining the Fed board, where she will then respond to questions from Donald Kohn, the former vice chair. Also on the Fed docket are Boston Fed president Susan Collins, Richmond Fed president Tom Barkin and Fed Gov. Michelle Bowman, as trade deficit and consumer credit data also are set for release.

Best of the web

Why Americans are so down on a strong economy

These two threats could topple Big Tech and erase U.S. stocks’ 2024 gains.

Tesla didn’t have a great month in South Korea in January: it sold one car.

Top tickers

Here are the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

PLTR, |

Palantir Technologies |

|

BABA, |

Alibaba |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

SNAP, |

Snap |

|

AMC, |

AMC Entertainment |

|

AMD, |

Advanced Micro Devices |

|

GME, |

GameStop |

The chart

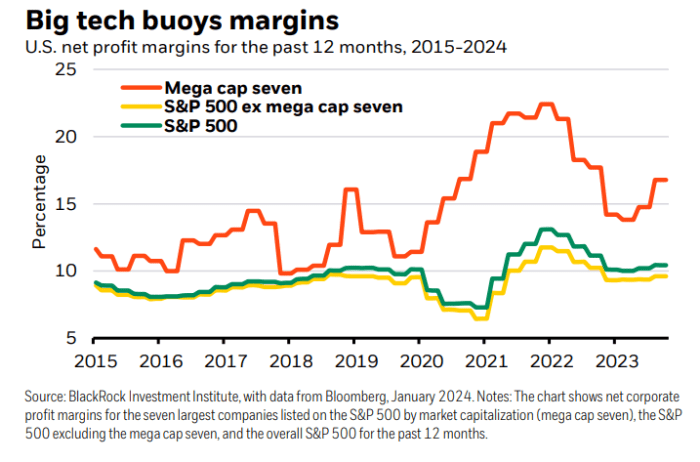

BlackRock Investment Institute created this chart showing profit margins, which they say have held up better than expected given the reversal of pandemic spending patterns and solid wage growth. But margins are very much divided, with those of the mega-cap tech firms rising while the rest of the S&P 500 pretty much tread water. “We think margins have room to fall further once cost cutting ends and inflation resurges,” they say.

Random reads

In Australia, a bill has been introduced to let workers ignore unreasonable after-hours calls and messages from their bosses.

Some high-powered working moms are turning to magic mushrooms.

Check out this award-winning photo of a polar bear sleeping on an iceberg.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet.