What should you expect for the stock market in 2024?

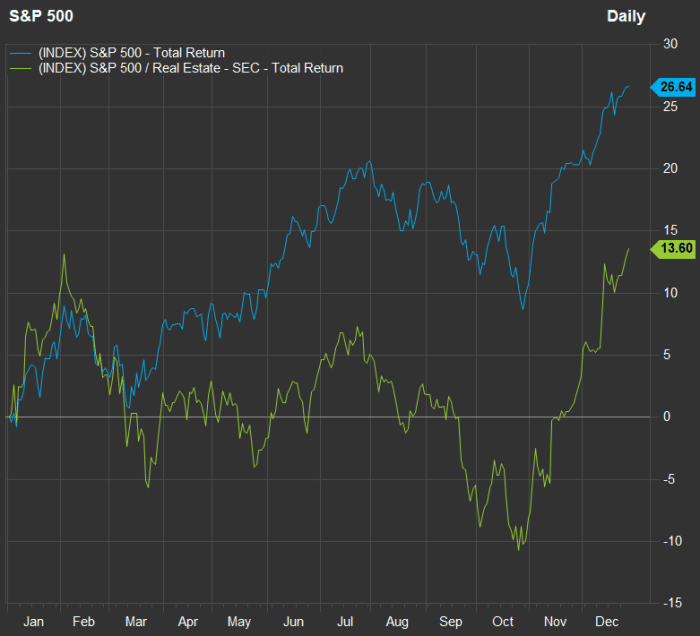

Investors have been enjoying quite a run-up into the end of the year. Take a look at this chart showing how the S&P 500 and its real-estate sector have performed this year through Thursday:

FactSet

Since its low for the second half of 2023 on Oct. 27, the S&P 500

SPX

has returned 16.6%, while the benchmark U.S. index’s real-estate sector has returned 26.5%. (All returns in this article include reinvested dividends.) Real-estate investment trusts have tax advantages in return for distributing at least 90% of their earnings to investors through dividend payments. So their prices tend to move in line with bond prices — in the opposite direction of interest rates. Bond prices have soared as the yield on 10-year U.S. Treasury notes

BX:TMUBMUSD10Y

has fallen to 3.87%, from 4.84% on Oct. 27.

The rally has been broad enough that the small-cap Russell 2000 index is on pace for its best December ever and its best month against the S&P 500 in almost 24 years.

Many investors are convinced the Federal Reserve has been successful in stamping out high inflation through its monetary-policy tightening that began in March 2022. The Fed’s own economic projections point to three cuts to the federal-funds rate in 2024, from its current target range of 5.25% to 5.50%.

But the stock market always looks ahead. So what should investors expect from here? If you are pouring money from every paycheck into a retirement account invested in index funds, a broad market decline may not bother you at all — you would be paying lower prices while continuing to contribute in a down market.

If you are a trader, a short-term investor or a market timer, Lawrence McMillan says technical analysis indicates the rally still has legs.

Then again, Mark Hulbert has a warning — that market sentiment is overwhelmingly bullish.

Here are the stocks that soared the most and sank the most during 2023.

Here’s sampling of opinion on what to expect from here:

What’s going on with commodities?

Getty Images/iStockphoto

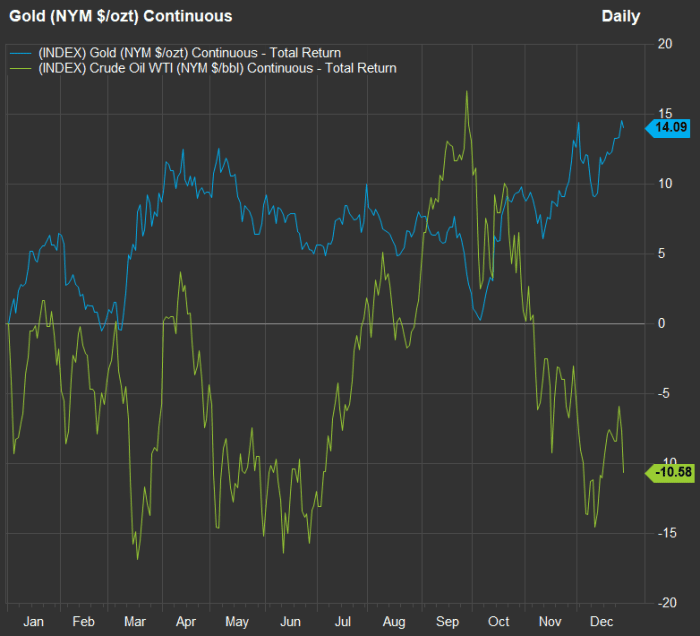

During 2023, many commodities suffered their biggest losses in five years, as Myra P. Saefong reports.

Here’s a chart showing percentage changes in prices for forward-month contracts for gold

GC00,

and for West Texas Intermediate crude oil

WBS00,

this year through Thursday:

FactSet

It might seem to be a busy chart, especially for oil, but the swings haven’t been very large. William Watts describes the recent action, including a record run for gold and a calming for oil prices. Oil has had its worst annual run since 2020.

Another warning from Hulbert: Inflation will have to get a lot worse to justify gold’s current price

Stock picks: A year-end setup

Getty Images/iStockphoto

Late each year, some investors will hurry to sell some stocks at a loss in order to offset capital gains on others and lower their tax bills. Michael Brush presents a diversified group of 10 stocks to consider after tax-loss selling has pushed them further down.

For income seekers, here’s a list of 11 stocks with dividend yields of at least 5% whose payouts appear to be well supported, based on consensus free-cash-flow estimates for 2024.

Here’s a roundup of favorite stocks for 2024 among analysts working for brokerage firms:

What to expect for ETFs in 2024

MarketWatch illustration/iStockphoto

The SPDR S&P 500 ETF Trust

SPY

is the oldest and largest exchange-traded fund, with $494 billion in assets under management. It tracks the S&P 500 by holding all of the index’s stocks, for an annual fee of 0.0945% of assets. It has returned 26.6% during 2023, as the U.S. stock market has been dominated by the “Magnificent Seven” stocks, which together make up 28.1% of the SPY portfolio. These seven companies (actually eight stocks when we include two common-share classes for Alphabet Inc.) have contributed 59% of the S&P 500’s total return this year, when weighted by their market capitalization at the end of 2022.

Here’s how the Magnificent Seven (including the two Alphabet share classes in the index) have performed in 2023 through Thursday:

| Company | Ticker | 2023 return | 2022 return | Return since end of 2021 | Forward P/E | Forward P/E at end of 2022 | Forward P/E at end of 2021 |

| Apple Inc. |

AAPL, |

50% | -26% | 10% | 29.0 | 20.5 | 30.2 |

| Microsoft Corp. |

MSFT, |

58% | -28% | 14% | 31.1 | 23.1 | 34.0 |

| Amazon.com Inc. |

AMZN, |

83% | -50% | -8% | 42.1 | 46.7 | 64.9 |

| Nvidia Corp. |

NVDA, |

239% | -50% | 69% | 24.7 | 34.4 | 58.0 |

| Alphabet Inc. Class A |

GOOGL, |

59% | -39% | -3% | 21.0 | 16.9 | 25.4 |

| Alphabet Inc. Class C |

GOOG, |

59% | -39% | -2% | 21.2 | 17.0 | 25.3 |

| Meta Platforms Inc. Class A |

META, |

198% | -64% | 7% | 20.3 | 14.7 | 23.5 |

| Tesla Inc. |

TSLA, |

106% | -65% | -28% | 66.2 | 22.3 | 120.3 |

| Source: FactSet | |||||||

Note that four of the eight stocks are still down from the end of 2021. SPY itself is up only 3.6% from the end of 2021, since the 26.6% gain in 2023 followed an 18.2% decline in 2022.

In this week’s ETF Wrap, Isabel Wang reviews the strategies that performed best during 2023, along with the ones that saw the largest inflows of client money, and shares insight into the 2024 ETF scene from Aniket Ullal, head of ETF data and analytics at CFRA.

Challenges to AI in 2024

Agence France-Presse/Getty Image

The New York Times

NYT,

made a big splash this week by suing Microsoft Corp.

MSFT,

and OpenAI, which created ChatGPT and has received billions of dollars in funding from Microsoft. The media company has accused Microsoft and OpenAI of using its copyrighted content without its permission “to build substitutive products.“

Another concern for artificial-intelligence technology next year will be its possible use to spread false information during the 2024 election cycle, as Jon Swartz reports.

A more positive take: Artificial intelligence may be ‘iPhone moment’ for Microsoft in price target hike, analyst says

Is the end of the year a good time to change your retirement investing strategy?

Alessandra Malito writes the Help Me Retire column. This week she helps a widow whose investment portfolio hasn’t changed in value from two years ago. Here’s what she should consider doing now.

Also read: I’m 56 and have $3.4 million in assets. I’m semiretired, but my spouse, 64, has no savings. How do we move forward?

More for retired investors: Is this the end for high annuity yields?

A year-end party for the Moneyist

MarketWatch illustration

Well, maybe not. Quentin Fottrell is the Moneyist. He helps readers who write to him with sensitive and sometimes painful questions about financial etiquette and money-related conflicts.

Here are two recent examples:

- My mother’s will leaves her house to her two children and two nieces, but she sold her home. Could these nieces come after us for the money?

- ‘My friend is a die-hard feminist’: When her future husband asked her out, she insisted they split the bill and he said, ‘Great!’ Who should pay on a first date?

Holiday hope for housing

Getty Images/iStockphoto

Aarthi Swaminathan covers residential real estate. To bring in the new year, she shares the “magic number” for mortgage rates that might unfreeze the U.S. housing market.

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.